Simple vs Compound Interest: Whats the Difference?

Compound interest is an investment where the amount of the return on your initial investment is added to that initial investment and then earns interest. A compounding period is any time interval when this process occurs, whether it be each day, each quarter, or each year. Interest rates are usually given as an annual percentage rate (APR) – the total interest that will be paid in the year. If the interest is paid in smaller time increments, the APR will be divided up. The more frequent the compounding, the more money an account holder should have in savings, if all other factors are equal.

Example #5: Calculating APY Based on an Annual Rate

Directly we can use the formula for calculating the interest for the second year, which will give us the same result. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly.

Show answerHide answer

Compounding can have a dramatic impact on investment results, both positive and negative. You can use the rule of 72 to see how small changes in interest rates can make a big difference. If you divide 72 by an interest rate, the result is the number of years it takes for your money to double.

How compound interest is calculated

- This interest is then added to the accumulated amount to determine the base for the next day’s interest calculation.

- Simple interest is calculated only on the original principal, while compound interest is calculated on the original principal plus any unpaid interest.

- He will need to convert the annual rate to an APY to compare them.

- This shows how compound interest quickly adds up when borrowing—and how carefully you should consider big loans that you pay back over a long time.

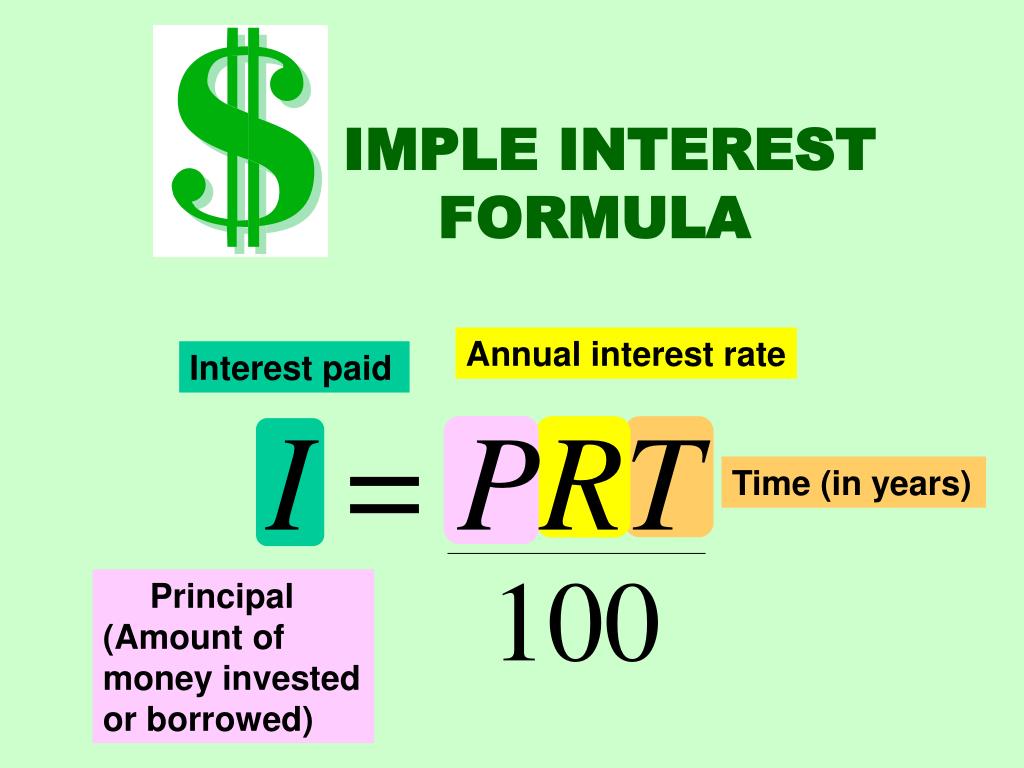

- We can use the simple interest formula to find a formula for the amount of money A that will be in a simple interest account after t years.

There can be a big difference in the amount of interest payable on a loan if interest is calculated on a compound basis rather than on a simple basis. But the magic of compounding can work to your advantage when it comes to your investments. Compounding interest doesn’t only apply to loans; it can apply to investments as well. Compound Annual Growth Rate, or CAGR, is a metric used to determine the return over time of an investment in a compounding environment.

Compounding on Investments and Debt

Compounding interest doesn’t only apply to loans; it can apply to investments as well. Typically, compounding interest works for the benefit of investors who see compounding return, but works against borrowers who have to pay off an exponentially growing loan balance. In the following sections, we’ll explore variations of the formula for annual, quarterly, monthly and daily compounding. We’ll also provide a more detailed step-by-step explanation ofhow to use the formula and discuss how to it within an Excel spreadsheet. Compound Interest can be defined as when the sum principal amount exceeds the due date for payment, along with the rate of interest for a period of time. But what if we have a series of values, like regular loan payments or yearly investments?

Simple interest is calculated only on the original principal, while compound interest is calculated on the original principal plus any unpaid interest. At the end of the month, over 536 million grains of rice would be awarded on the last day. When you hit your 45-year savings mark—and your twin would have saved for 15 years—your twin will have less, although they would have invested roughly twice your principal investment. What if Sam wanted to know (without stopping to calculate the interest alone) what his total account balance would be at the end of five years? In that case, he would use a different formula that would give him the total.

If you take on compounding debt, you’ll be stuck in a growing debt balance longer. By compounding interest, financial balances are able to exponentially grow faster than straight-line interest. In addition, without having added new investments on our own, our investment has grown $6,288.95 in 10 years.

We recognize that, for some of our Addition Financial members (and prospective members), it may be difficult to visualize what a big difference compound interest can make in your savings. We also know that you may not know how to calculate compound interest to maximize your earning potential. In this post, we’ll share six compound interest examples and simple interest examples, along with the formulas you can use to compare accounts and put your money to work for you.

Compound interest simply means you’re earning interest on both your original saved money and any interest you earn on that original amount. Although the term « compound interest » includes the word interest, the concept applies beyond interest-bearing bank accounts what is certified payroll 2021 requirements and faq and loans, including investments such as mutual funds. They invest $5,000 initially, then $500 monthly for 15 years, also averaging a monthly compounded 4% return. By age 65, your twin has only earned $132,147, with a principal investment of $95,000.

A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation. But the interest rate that is stated in annual terms must be reduced accordingly. Thus, instead of using an interest rate of 12% in our example, the interest rate would be 3% each quarter. The interest and accumulated amount at the end of year 3 are calculated in the same way.

Compound interest can significantly boost investment returns over the long term. Over 10 years, a $100,000 deposit receiving 5% simple annual interest would earn $50,000 in total interest. But if the same deposit had a monthly compound interest rate of 5%, interest would add up to about $64,700. While compound interest is interest-on-interest, cumulative interest is the addition of all interest payments.