Average Collection Period: Understanding Its Importance in Business Finance

If customers feel that your credit terms are a bit too restrictive for their needs, it may impact your sales. For example, financial institutions, i.e., banks, rely on accounts receivable because they offer their customers credit loans, installments, and mortgages. A short and precise turnaround time is required to generate ROI from such services (you can find more about this metric in the ROI calculator). Thus, by neglecting their policies for managing accounts receivable, they can potentially have a severe financial deficit. Calculating the average collection period with average accounts receivable and total credit sales. 💡 You can also use the same method to calculate your average collection period for a particular day by dividing your average amount of receivables by your total credit sales of that day.

Understanding the Formula of Average Collection Period

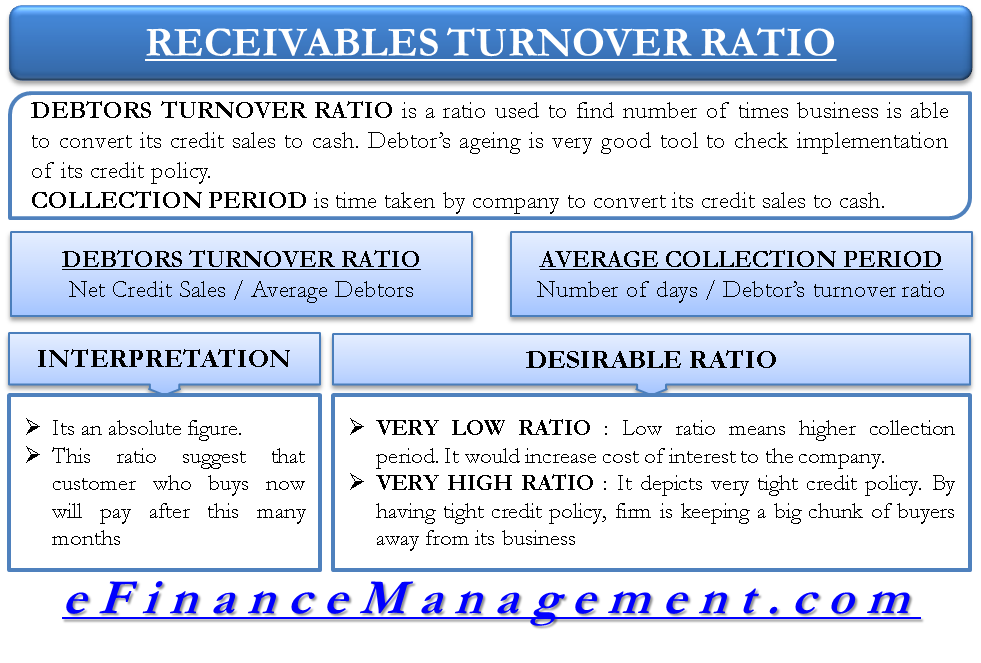

As such, they indicate their ability to pay off their short-term debts without the need to rely on additional cash flows. Key performance metrics such as accounts receivable turnover ratio can measure your business’s ability to collect payments in a timely manner, and is a reflection of how effective your credit terms are. You have to divide a company’s average accounts receivable balance by the net credit sales and then multiply the quotient into 365 days.

What does a low average collection period indicate?

- Without tracking the ACP, it will become difficult for businesses to plan for future expenses and projects.

- The average collection period formula is the number of days in a period divided by the receivables turnover ratio.

- Businesses must manage their average collection period if they want to have enough cash on hand to fulfill their financial obligations.

- For example, the banking sector relies heavily on receivables because of the loans and mortgages that it offers to consumers.

- The average collection period (ACP) is the time taken by businesses to convert their accounts receivable (AR) to cash.

- A longer collection period might indicate financial distress, as it could mean customers are struggling to pay their bills, or the company is not enforcing its collection terms strictly enough.

By benchmarking against the industry standard, a company can gauge easily whether the number is acceptable or if there is potential for improvement. In the following example of the average collection period calculation, we’ll use two different methods. Let us now do the what is a accounts receivable journal entry average collection period analysis calculation example above in Excel. For example, if a company has a collection period of 40 days, it should provide days. Since the company needs to decide how much credit term it should provide, it needs to know its collection period.

Significance of the Average Collection Period

A longer average collection period signifies that a company is more lenient or slower in collecting its receivables. This scenario causes funds to be tied up in debtors for an extended period, potentially leading to cash flow issues. A firm with cash flow problems may struggle to meet its operational and financial obligations like payroll, inventory purchases, and loan payments. In the long run, constant cash flow problems can jeopardize the firm’s sustainability. The business model employed by a company can greatly impact the average collection period.

So if a company has an average accounts receivable balance for the year of $10,000 and total net sales of $100,000, then the average collection period would be (($10,000 ÷ $100,000) × 365), or 36.5 days. Companies typically favour a lower average collection period because it means there’s a shorter time between converting your average balance from accounts receivable to cash. By aggressively pursuing collections, businesses may strain their relationships with customers. If customers perceive the firm’s collection practices as overly harsh or inflexible, it may lead to customer dissatisfaction, damaging the company’s reputation. Over time, this could potentially lead to loss of business, negatively impacting the company’s sales and profits.

In gauging a company’s operational effectiveness, the average collection period plays a significant role. It is a reflection of how quickly a business collects its receivables, and therefore, how efficiently its operations are managed. A shorter collection period indicates that a company collects money from its customers promptly, suggesting efficient credit and collections departments.

However, it may also imply stricter credit terms which could deter potential customers seeking more lenient payment terms. The average collection period is the length of time it takes for a company to receive payment from its customers for accounts receivable (AR). This metric is critical for companies that rely on receivables to maintain their cash flow and meet financial obligations. By measuring the typical collection period, businesses can evaluate how effectively they manage their AR and ensure they have enough cash on hand. The average collection period is used a few different ways to measure cash flow performance. Overall shorter collection periods increase liquidity and generate better cash flow efficiency.

While ACP focuses on the length of time required to collect receivables, CCC offers a broader perspective on how efficiently a business converts its current assets, such as inventory and AR, into cash. This conversion process highlights how effectively a company manages its cash flows while minimizing its working capital requirements. Average Collection Period plays a significant role in shaping credit terms and customer relationships. A shorter average collection period suggests that a company efficiently manages its receivables, while a longer one implies less effective AR management. You can calculate the average accounts receivable balance by taking the average of the beginning and ending balances over a given period.